Plan Wisely for the Future

Essential life insurance to protect your loved ones and tax shelter your corporate investments.

Providing insightful life insurance advice is the heart of my practice. In fact, it’s been the focus of my career for close to a decade.

Life insurance is more complex than you may think. It should be a part of your financial solution for a myriad of reasons:

For individuals, Life Insurance will:

- provide financial security for those you love

- eliminate liabilities and look after the cost of funeral expenses

- leave a legacy for future generations — or charitable organizations that you care about

For business owners, Life Insurance will:

- shelter your corporate investments from high levels of taxation

- protect your business interests should the unexpected occur

- protect your family’s best interests

Together, let’s create a plan and purchase a policy that’s right for you. As an independent advisor, I am unbiased, solution-agnostic– and will make informed selections from a full range of Canadian financial products and services.

Life insurance – explained in simple language

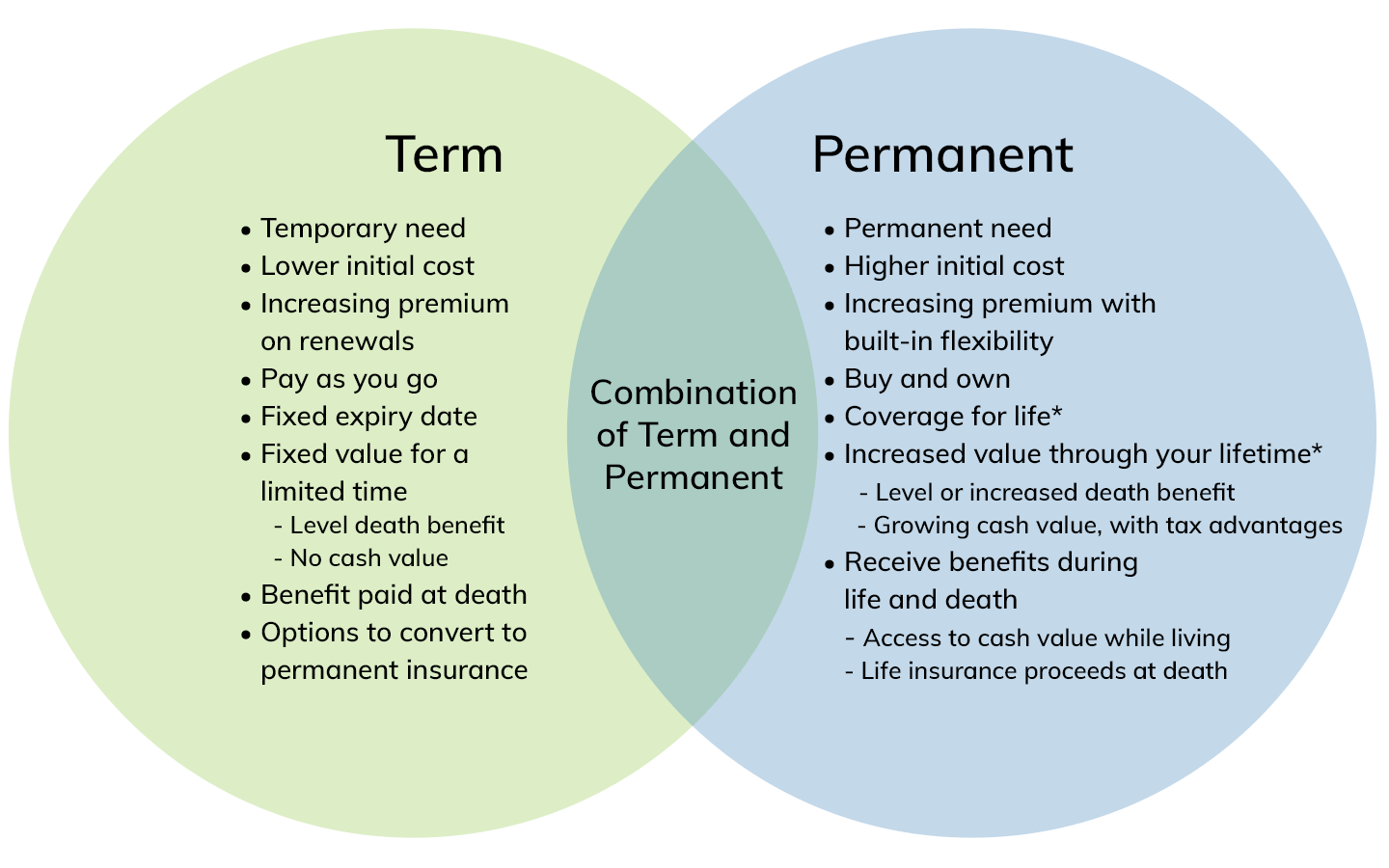

Term Insurance:

Cost-effective insurance for a fixed-term period – convertible into permanent coverage (without needing to medically qualify). Commonly purchased as a 10yr term (T10), or 20yr term (T20).

Permanent Insurance:

With a permanent life insurance policy, you have the opportunity to grow cash value within your policy over time. Let’s find the best policy for you to help achieve your financial goals like:

- supplementing your retirement income

- paying for your children’s education.

- taking your business to the next level

Universal Life:

- Permanent insurance solution that allows you to overfund your policy and realize tax exempt growth on your investment.

Whole Life:

- Permanent insurance solution that allows your investments and death benefit to grow annually (as each year’s declared dividends increase your policy values)